MN JGM301 2012-2025 free printable template

Show details

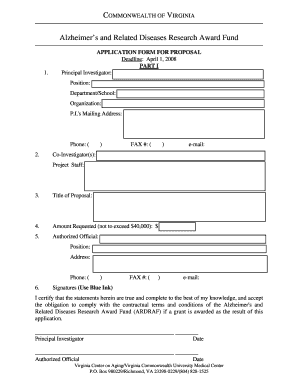

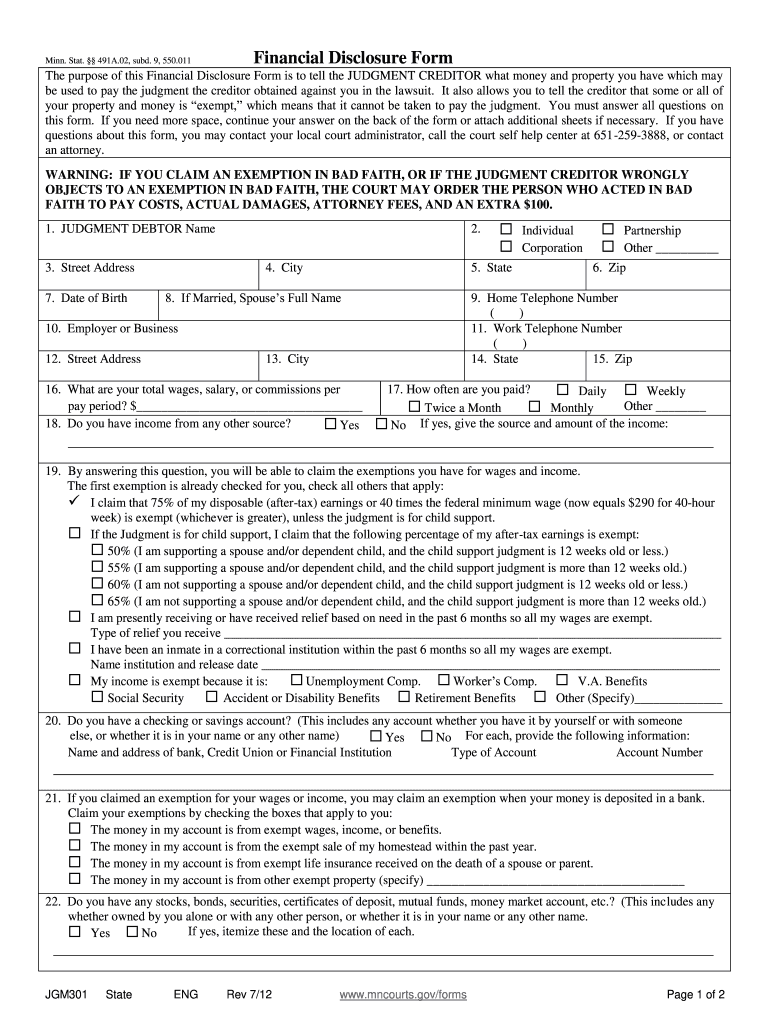

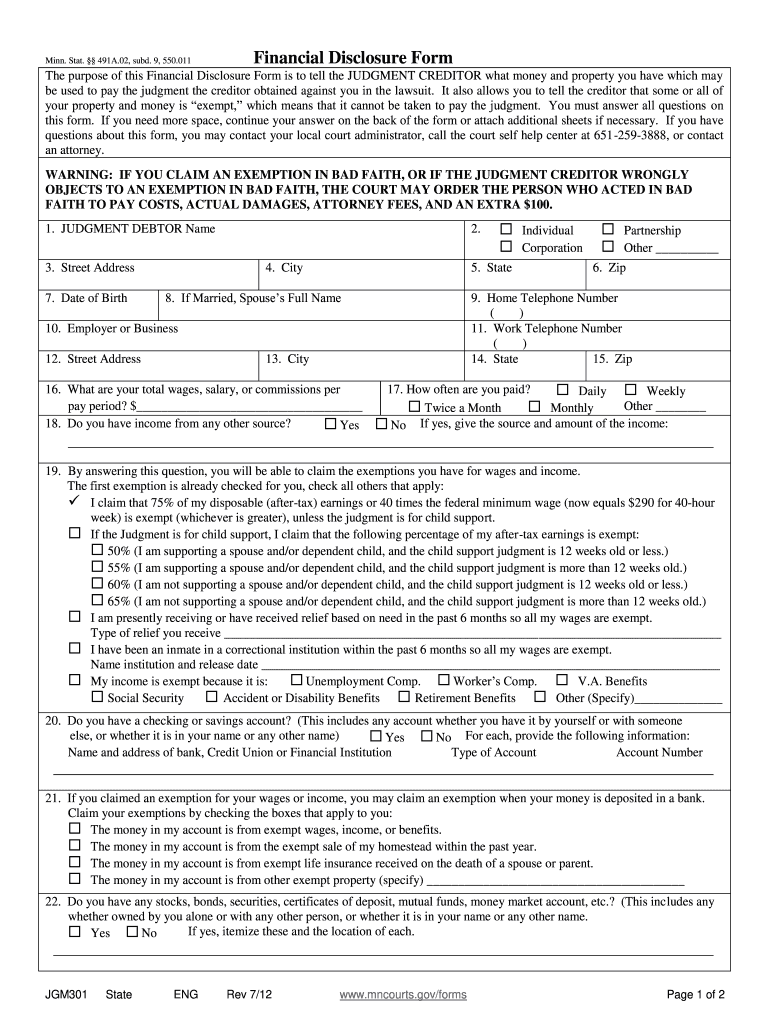

Minn. Stat. 491A. 02 subd. 9 550. 011 Financial Disclosure Form The purpose of this Financial Disclosure Form is to tell the JUDGMENT CREDITOR what money and property you have which may be used to pay the judgment the creditor obtained against you in the lawsuit. If yes itemize these and the location of each. Yes No JGM301 ENG Rev 7/12 www. mncourts. gov/forms Page 1 of 2 23.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign minnesota disclosure form get

Edit your minnesota disclosure form print form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your minnesota disclosure form printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit minnesota financial disclosure form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mn financial disclosure form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out minnesota financial disclosure form

How to fill out MN JGM301

01

Obtain a blank MN JGM301 form from the relevant government website or office.

02

Fill out the top section with your personal details, including your name, address, and contact information.

03

Provide the specific details requested in the middle section, such as the nature of the application or request.

04

Attach any required documentation or evidence that supports your application.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the MN JGM301 either online or via mail, following the instructions provided.

Who needs MN JGM301?

01

Individuals or businesses applying for certain permits or licenses in Minnesota.

02

Those required to report specific transactions or changes as mandated by state regulations.

03

Anyone seeking to request a public record or make changes to existing documentation.

Fill

trial minnesota financial disclosure

: Try Risk Free

People Also Ask about mn disclosure form template

What is complete financial disclosure?

Financial disclosure means providing the other party and the court with information and documentation about your finances, including your: income (how much you make) expenses (how much you spend on things like rent and childcare) assets (how much property or other valuables you own) debts (any money you owe)

What is a financial disclosure for a security clearance?

You need to disclose everything in your financial situation, such as current and outstanding loans, credit cards, child support/spousal support, monetary gifts, real estate and investments.

What is a financial disclosure requirement?

Individuals are required to file a Financial Disclosure Statement once they “qualify” as a candidate by raising or spending more than $5,000 in a campaign for election to the House of Representatives. Both the office-seeker's own funds and contributions from third parties count towards the threshold.

What is a financial disclosure for federal employees?

Financial disclosure reports are used to identify potential or actual conflicts of interest. If the person charged with reviewing an employee's report finds a conflict, he should impose a remedy immediately. The employee's supervisor, with his ethics official, should decide on the remedy.

What is the process of financial disclosure?

The process of financial disclosure on divorce & separation is where you will give full details of your personal financial position, resources, and future needs. This will normally be exchanged between you and your partner. If there are financial remedy proceedings, you will also provide copies to the Family Court.

What does a financial disclosure look like?

A Financial Disclosure Statement is a document in which the party completing it should report all of his or her income, assets, debts and expenses. Spouses rely on the information reported in order to arrive at a fair division of assets and debts and income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is minnesota financial disclosure?

Minnesota Financial Disclosure is the process of disclosing any financial information that is relevant to an individual's or organization's financial situation. This includes information about income, assets, debts, liabilities, investments, and any other financial interests. This information must be provided to Minnesota's Campaign Finance and Public Disclosure Board for review and approval, before any political contributions can be accepted or spent.

What information must be reported on minnesota financial disclosure?

In Minnesota, financial disclosure is required for certain public officeholders and candidates. This includes information about the individual’s occupation, employer, sources of income, investments, debts, and certain other financial interests. The information must be reported on the Minnesota Campaign Finance and Public Disclosure Board’s Form F-1.

Who is required to file minnesota financial disclosure?

According to the Minnesota Statutes, certain officials and employees are required to file a financial disclosure statement. This includes elected officials, such as state legislators, constitutional officers, and judges, as well as individuals appointed to certain boards, commissions, or other positions by the governor or other executive branch officials. The specific requirements and thresholds for filing vary depending on the position held. It is recommended to consult the Minnesota Statutes or contact the Minnesota Campaign Finance and Public Disclosure Board for more detailed information.

How to fill out minnesota financial disclosure?

To fill out the Minnesota Financial Disclosure form, follow these steps:

1. Obtain the form: You can download the form from the official website of the Minnesota Judicial Branch under the "Forms" section, specifically Form 11.10 (Financial Affidavit). You may need to search for "Minnesota Financial Disclosure form" to find the correct form.

2. Provide personal information: Fill in your personal details at the top of the form, such as your name, address, phone number, and email address. Ensure accuracy and legibility.

3. Specify the case information: If the form is related to a specific legal case, mention the case name, court file number, and the judicial district where the case is filed.

4. Provide financial information: The heart of the form is the financial disclosure section. You will need to provide various financial details, including:

- Income: Estimate your gross and net monthly income from all sources. Include wages, self-employment income, Social Security, retirement, rental income, etc.

- Assets: List all your assets, such as real estate, vehicles, bank accounts, investments, retirement accounts, and any significant personal properties. Include current values and the amount of any loans or mortgages against these assets.

- Debts and liabilities: Disclose any outstanding debts, mortgages, loans, credit card balances, student loans, etc. Specify the creditor's name, the balance owed, and your monthly payment amount.

- Living expenses: Complete the monthly expenses section, including housing costs, utilities, food, transportation, medical expenses, insurance premiums, child care costs, and any other regular expenses.

5. Sign and date the form: After reviewing your entries to ensure accuracy, sign and date the form at the bottom. If necessary, consult with an attorney for any legal advice before signing.

6. Submit the form: Make copies of the completed form for your own records. There may be specific instructions on how to submit the form, so check with the court or your attorney, if applicable. Bring or mail the original form to the appropriate legal authority or attach it to the relevant court filings.

Remember that this advice provides a general overview of filling out the form, but it's always recommended to refer to the specific instructions mentioned on the form itself or consult with an attorney if you have any questions or concerns.

What is the purpose of minnesota financial disclosure?

The purpose of Minnesota financial disclosure is to promote transparency and accountability in governmental affairs by requiring certain individuals in public positions to disclose their financial interests. This enables the public to know about any potential conflicts of interest that could influence the decision-making of public officials. By requiring officials to disclose their financial holdings, investments, outside employment, and other relevant financial information, it helps ensure that public officials act in the best interest of the public and maintain the public's trust. It also helps prevent corruption and malfeasance by identifying any potential ethical violations.

How do I modify my mn financial disclosure template in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your disclosure financial minnesota and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send income tax for eSignature?

To distribute your minnesota disclosure financial, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an eSignature for the mn financial disclosure in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your financial minnesota disclosure and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is MN JGM301?

MN JGM301 is a form used in Minnesota for reporting specific tax information, typically related to corporate or business taxes.

Who is required to file MN JGM301?

Entities that meet certain criteria, such as corporations, partnerships, or businesses operating in Minnesota, are required to file MN JGM301.

How to fill out MN JGM301?

To fill out MN JGM301, gather the necessary financial information, complete the form with accurate figures, and ensure all required sections are filled before submitting it to the appropriate state department.

What is the purpose of MN JGM301?

The purpose of MN JGM301 is to provide the state with information about a business's tax obligations and to ensure compliance with state tax laws.

What information must be reported on MN JGM301?

Information that must be reported on MN JGM301 typically includes business identification details, income, expenses, and tax calculations specific to the reporting period.

Fill out your MN JGM301 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Disclosure Minnesota is not the form you're looking for?Search for another form here.

Keywords relevant to minnesota disclosure form fillable

Related to disclosure minnesota financial

If you believe that this page should be taken down, please follow our DMCA take down process

here

.